Got Cash, Gift Cards, or a Bonus? Financial Hacks to Spend Them Right

Extra money has a funny effect on the brain. A bonus lands, a gift card shows up, or cash appears in a birthday card, and suddenly, rules feel optional. This money feels lighter than your paycheck. It whispers, “Spend me fast.” That voice is charming, but it is also sneaky. Before the money disappears into takeout and impulse clicks, pause for a breath. Extra funds are powerful because they arrive without obligation. They can relieve pressure, fix annoyances, or quietly improve future stability. The trick is using them with intention, not urgency. A smart plan now keeps regret off the guest list later.

Split the Money Before You Touch It

The smartest move happens before spending starts. Divide the money into simple buckets right away. One part can be enjoyed freely. One part should support future needs. This quick split removes guilt from spending and discipline from saving. Think of it like slicing a pizza. One slice for fun tastes better when the rest is accounted for. This approach avoids all-or-nothing thinking. You get enjoyment without wrecking progress. Balance keeps money from turning into emotional whiplash.

Fix Small Financial Leaks First

Extra money is perfect for quiet fixes. Pay off a lingering balance. Cover a bill that keeps popping up. Replace something broken instead of juggling it again. These small repairs reduce mental clutter. Fixing leaks does not feel exciting, but it feels calming. Less stress improves decision-making later.

Use Gift Cards Like Cash With a Mission

Gift cards often get spent on things you would not normally buy. Treat them like real money with a job. Decide what problem they will solve before using them. A grocery card can offset food costs for weeks. A store card can replace something already planned. This approach stretches value quietly.

Turn Part of a Bonus Into Future Relief

Bonuses feel big, even when they are modest. That feeling makes people spend fast. Instead, use part of it to buy future peace. Build a buffer. Catch-up savings. Reduce debt pressure. Future relief compounds emotionally. Knowing you have backup funds changes how money stress feels. You walk lighter through unexpected expenses.

Spend the Fun Portion Without Second-Guessing

Money plans fail when joy gets excluded. Set aside a clear, fun portion and actually use it. No spreadsheets. No guilt. Enjoyment matters because deprivation leads to rebound spending. So, make sure to buy something that improves daily life. A small upgrade you use often beats a flashy item you forget. Enjoy the purchase fully.

Avoid Letting Extra Money Redefine Your Lifestyle

One-time money should not create permanent habits. Avoid upgrading recurring expenses based on temporary funds. Monthly commitments linger long after the bonus is gone. That is how stress sneaks back in quietly. Keep lifestyle steady. Let extra money stay extra. One-off treats are safer than ongoing costs.

This protects future budgets from shrinking. Stability matters more than appearances. Extra money does not need complicated rules. It needs calm decisions made early. A simple plan keeps emotions from driving. You get progress without pressure and enjoyment without fallout. That is money used right.…

Effective branding can significantly boost revenue generation. When your brand resonates with consumers, they are likelier to choose your products over competitors’. A strong identity creates an emotional connection that drives purchasing decisions. Think about it: recognizable brands often command premium prices. Customers trust them and perceive their offerings as higher quality.

Effective branding can significantly boost revenue generation. When your brand resonates with consumers, they are likelier to choose your products over competitors’. A strong identity creates an emotional connection that drives purchasing decisions. Think about it: recognizable brands often command premium prices. Customers trust them and perceive their offerings as higher quality.

Many employers offer a matching contribution when you contribute to your 401(k). This is essentially free money, so it’s important to take full advantage of this. If your employer will match 3% of your contribution, ensure you’re contributing at least 3% to get the full match. The more you contribute, the more money you can save over time. In short, don’t leave free money on the table.

Many employers offer a matching contribution when you contribute to your 401(k). This is essentially free money, so it’s important to take full advantage of this. If your employer will match 3% of your contribution, ensure you’re contributing at least 3% to get the full match. The more you contribute, the more money you can save over time. In short, don’t leave free money on the table.

Finally, one of the most common 401(k) mistakes is investing too aggressively. While it can be tempting to invest in riskier investments that promise higher returns, it’s important to remember that they also come with a much higher risk of losing money. It’s better to take a more conservative approach and invest in low-risk investments such as index funds and bonds. This will help ensure that you don’t lose your money if the market takes a downturn.

Finally, one of the most common 401(k) mistakes is investing too aggressively. While it can be tempting to invest in riskier investments that promise higher returns, it’s important to remember that they also come with a much higher risk of losing money. It’s better to take a more conservative approach and invest in low-risk investments such as index funds and bonds. This will help ensure that you don’t lose your money if the market takes a downturn.

If you know anyone who has recently purchased a home, ask them who they worked with and if they were happy with the experience. Getting referrals from people you trust is a great way to narrow down your options. Another option is to look for online reviews of mortgage brokers in your area. It can be helpful to read both positive and negative reviews to get a well-rounded idea of what others have experienced.

If you know anyone who has recently purchased a home, ask them who they worked with and if they were happy with the experience. Getting referrals from people you trust is a great way to narrow down your options. Another option is to look for online reviews of mortgage brokers in your area. It can be helpful to read both positive and negative reviews to get a well-rounded idea of what others have experienced. Not all mortgage brokers offer the same loan products. Some may only work with specific lenders, while others may have a more diverse selection.

Not all mortgage brokers offer the same loan products. Some may only work with specific lenders, while others may have a more diverse selection.

In business, everything has to be realistic, especially when it comes to monetary goals. A financial advisor can help you develop a realistic budget that will work for your business and make sure you stick to it, no matter what.

In business, everything has to be realistic, especially when it comes to monetary goals. A financial advisor can help you develop a realistic budget that will work for your business and make sure you stick to it, no matter what. Tax strategies can be tricky, especially when it comes to small businesses. A financial advisor will be able to advise you on the best tax strategies that will benefit your business and make sure you’re paying the least amount of taxes possible.

Tax strategies can be tricky, especially when it comes to small businesses. A financial advisor will be able to advise you on the best tax strategies that will benefit your business and make sure you’re paying the least amount of taxes possible.

The second essential factor you should consider before selecting any Forex trading website is money. Ensure that you make a budget on the amount of money you wish to spend on Forex trading sites. It is essential to note that the Forex trading sites will ask for money to provide broking services.

The second essential factor you should consider before selecting any Forex trading website is money. Ensure that you make a budget on the amount of money you wish to spend on Forex trading sites. It is essential to note that the Forex trading sites will ask for money to provide broking services. The last factor you should consider before selecting a Forex trading site is security. It would be best if you never compromise online safety. Many have lost essential personal and financial details by using Forex trading sites that are insecure. Since your security is a priority, you should ensure that you select a website with reliable and adequate security measures.

The last factor you should consider before selecting a Forex trading site is security. It would be best if you never compromise online safety. Many have lost essential personal and financial details by using Forex trading sites that are insecure. Since your security is a priority, you should ensure that you select a website with reliable and adequate security measures.

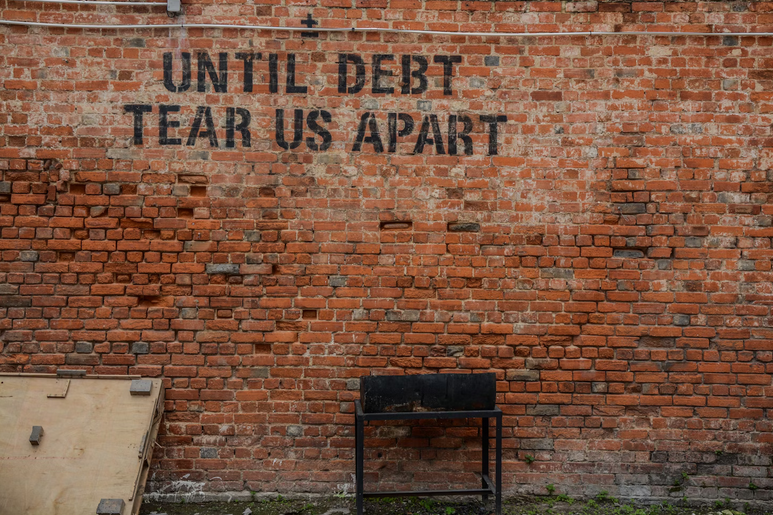

The reason why many people take a break is for the safe of restrategizing. Filing for bankruptcy is the last resort after trying to solve all your financial difficulties. Sometimes you need to catch a break so that you can restrategize.

The reason why many people take a break is for the safe of restrategizing. Filing for bankruptcy is the last resort after trying to solve all your financial difficulties. Sometimes you need to catch a break so that you can restrategize.

Hiring a bankruptcy lawyer is essential in lessening the stress that comes with financial challenges. Moreover, you also need their experience to improve the chances of getting your application awarded. As a tip, always work with the best bankruptcy lawyer and you will be assured of acceptable results.…

Hiring a bankruptcy lawyer is essential in lessening the stress that comes with financial challenges. Moreover, you also need their experience to improve the chances of getting your application awarded. As a tip, always work with the best bankruptcy lawyer and you will be assured of acceptable results.…

The primary benefit of a tax refund loan is that you can receive the money and spend it earlier. That is because the loan is processed quickly and you can get the money in your bank account within a few days. Thus, this type of loan can be quite beneficial when you have urgent bills that ought to be paid, and you cannot wait for the refund to arrive through normal channels.

The primary benefit of a tax refund loan is that you can receive the money and spend it earlier. That is because the loan is processed quickly and you can get the money in your bank account within a few days. Thus, this type of loan can be quite beneficial when you have urgent bills that ought to be paid, and you cannot wait for the refund to arrive through normal channels. Like other types of loans, a tax refund loan depends on your financial circumstances. For instance, if you do not require funds urgently, then it is advisable to wait for your refund to be processed in the normal way, instead of spending your money on interest and fees. However, if you need money urgently and you are ready to receive less of the tax refund, then this type of loan is suitable for you as you will get the money within a few days.

Like other types of loans, a tax refund loan depends on your financial circumstances. For instance, if you do not require funds urgently, then it is advisable to wait for your refund to be processed in the normal way, instead of spending your money on interest and fees. However, if you need money urgently and you are ready to receive less of the tax refund, then this type of loan is suitable for you as you will get the money within a few days.

The first way to deal with such changes is to maximize the potential of the assets. Not, it is not talking about the physical assets, like the building and production equipment, but it is about the clients. As a source of income, clients play a vital role in maintaining business stability. For that reason, retaining their loyalty is urgently pivotal as they are the ones who can take a company through all the economic changes. Experts often state that it is always easy to attract a client. However, retaining their loyalty is another matter. There are steps to take and tricks to do to make sure they give their commitment to the company.

The first way to deal with such changes is to maximize the potential of the assets. Not, it is not talking about the physical assets, like the building and production equipment, but it is about the clients. As a source of income, clients play a vital role in maintaining business stability. For that reason, retaining their loyalty is urgently pivotal as they are the ones who can take a company through all the economic changes. Experts often state that it is always easy to attract a client. However, retaining their loyalty is another matter. There are steps to take and tricks to do to make sure they give their commitment to the company.

The flexible nature of small business loans reflects in their repayment options as well. Banks offer such flexibility since they understand the complexities involved with businesses and their plans are accordingly designed. They may provide repayment plans according to the cash flow to avoid the difficulties in financial management. Borrowers also decrease or increase the EMI according to the financial condition of the company. Also, they can choose bullet payments for periodic repayments.

The flexible nature of small business loans reflects in their repayment options as well. Banks offer such flexibility since they understand the complexities involved with businesses and their plans are accordingly designed. They may provide repayment plans according to the cash flow to avoid the difficulties in financial management. Borrowers also decrease or increase the EMI according to the financial condition of the company. Also, they can choose bullet payments for periodic repayments.

Knowing that you will be able to repay your loan without affecting your monthly expenses is essential. The first thing you need to do is calculate all your monthly costs and know your current expenses. And now that you are purchasing a car, you also need to know the amount you will be spending on fuel and other minor issues like repairs. If you are comfortable with your budget, then you are ready to get that loan and purchase your dream car.

Knowing that you will be able to repay your loan without affecting your monthly expenses is essential. The first thing you need to do is calculate all your monthly costs and know your current expenses. And now that you are purchasing a car, you also need to know the amount you will be spending on fuel and other minor issues like repairs. If you are comfortable with your budget, then you are ready to get that loan and purchase your dream car. When requesting for a loan, you should also consider the repayment period. Note that the repayment period can also affect the interest rate you will be charged. Loans that take a more extended period are likely to attract a higher rate since your lender will be waiting for long to get their money back. However, the amount you will be paying on each installment will be significantly lower. Therefore, you should get your math right.

When requesting for a loan, you should also consider the repayment period. Note that the repayment period can also affect the interest rate you will be charged. Loans that take a more extended period are likely to attract a higher rate since your lender will be waiting for long to get their money back. However, the amount you will be paying on each installment will be significantly lower. Therefore, you should get your math right.

When you do financial planning, you will be able to tell the amount of cover that you need. You require health and life covers as you push on. Therefore, with proper financial planning, you will determine the amount that you will use for each cover. This aspect will ensure that you don’t underpay for the cover or you don’t overpay for the cover.

When you do financial planning, you will be able to tell the amount of cover that you need. You require health and life covers as you push on. Therefore, with proper financial planning, you will determine the amount that you will use for each cover. This aspect will ensure that you don’t underpay for the cover or you don’t overpay for the cover.

Many of us already know that there is enough free time that a student in a university or college can stay idle. Lectures do not run from morning to evening! A student can be able to make three to four hours in a day. These hours should be used effectively by enrolling in a work-study program.

Many of us already know that there is enough free time that a student in a university or college can stay idle. Lectures do not run from morning to evening! A student can be able to make three to four hours in a day. These hours should be used effectively by enrolling in a work-study program. In the recent past, banks have started giving out study loans to needy students. To make the matter more interesting, the loans are payable when the student is done with studies and can be able to raise re-payment installments.

In the recent past, banks have started giving out study loans to needy students. To make the matter more interesting, the loans are payable when the student is done with studies and can be able to raise re-payment installments.

your insurance company can pay some of your death benefits in advance to cater for your treatment as you still breathe. Very convenient, right? It is this amazing and significant advantage that prompts a lot of people to rush and acquire a

your insurance company can pay some of your death benefits in advance to cater for your treatment as you still breathe. Very convenient, right? It is this amazing and significant advantage that prompts a lot of people to rush and acquire a  advantage of growing your finances and projects. If you want to get a loan, you do not have to wonder what you will use as security for your loan. The funds accumulated and your death benefits give you enough security to secure a loan with your banking institution. The loans do not have any restrictions on how you will spend the money. The life insurance policy guarantees you a loan anytime and for any valid reasons.

advantage of growing your finances and projects. If you want to get a loan, you do not have to wonder what you will use as security for your loan. The funds accumulated and your death benefits give you enough security to secure a loan with your banking institution. The loans do not have any restrictions on how you will spend the money. The life insurance policy guarantees you a loan anytime and for any valid reasons.

This is the first step to financial health. Be honest with yourself and compute how much you earn. If you have a fixed salary, that should be easy. If your salary is dependent on commissions, you can exclude that. If you have a business, you probably have a high and low season. Look at the trends of the last two or three years and come up with an average. After that, compute your expenses. Try to minimize the expenses by cutting off the unnecessary items so that you can save more.

This is the first step to financial health. Be honest with yourself and compute how much you earn. If you have a fixed salary, that should be easy. If your salary is dependent on commissions, you can exclude that. If you have a business, you probably have a high and low season. Look at the trends of the last two or three years and come up with an average. After that, compute your expenses. Try to minimize the expenses by cutting off the unnecessary items so that you can save more. Having a sense of direction in your life is important. Have a plan of where you would want to be in a few years. Your financial future has more importance than the latest car, phone or even holiday. If you invest in such, make sure that you balance them out with your long term plans and work hard towards ensuring that you abide by your plans.

Having a sense of direction in your life is important. Have a plan of where you would want to be in a few years. Your financial future has more importance than the latest car, phone or even holiday. If you invest in such, make sure that you balance them out with your long term plans and work hard towards ensuring that you abide by your plans.

Loan providers often have an eligibility criterion. Most of them prefer the borrowers to be of a particular age, preferably between 21 years to 65 years. They will also check the minimum amount you earn per annum and your previous credit loans. This is because they have to ensure that you are not a defaulter because in case you default, they will make losses.

Loan providers often have an eligibility criterion. Most of them prefer the borrowers to be of a particular age, preferably between 21 years to 65 years. They will also check the minimum amount you earn per annum and your previous credit loans. This is because they have to ensure that you are not a defaulter because in case you default, they will make losses. because any discrepancies may result in your loan being rejected. It is automatic for the lenders to cross check everything because that is their work. They will, therefore, do follow ups by calling or even visiting you. Giving out genuine information will thus increase the chances of getting your loan approved.

because any discrepancies may result in your loan being rejected. It is automatic for the lenders to cross check everything because that is their work. They will, therefore, do follow ups by calling or even visiting you. Giving out genuine information will thus increase the chances of getting your loan approved.