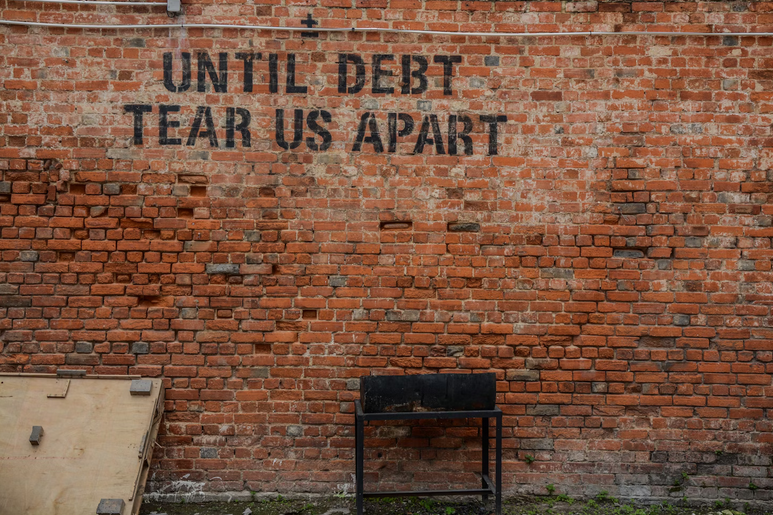

Debt can feel like a ghost haunting your financial freedom. You’re not alone if it’s creeping into your thoughts or lurking in the shadows of your budget. But don’t let it spook you! There are effective strategies to banish that debt and reclaim control over your finances faster than you might think.

Imagine waking up one day, free from those shackles, ready to pursue what truly matters to you. It starts with understanding where you stand and taking action. Whether it’s high-interest credit cards or lingering student loans, tackling them head-on is key. Let’s explore some practical methods that will help you exorcise that debt for good.

Prioritize High-Interest Debt

High-interest debt is like a black hole for your finances. The longer you let it linger, the more it drains your resources. Credit cards often top this list, with interest rates that can soar above 20%. So how do you do it? Start by identifying which debts carry the highest rates. You may find that paying these off first will save you a significant amount over time.

Once you’ve pinpointed them, focus your extra payments here. Even small amounts add up when directed at high-interest accounts. This approach not only reduces how much interest you pay overall but also accelerates your path to becoming debt-free. Remember, every dollar counts.

Use Snowball Method

This can be a powerful strategy for tackling debt. It starts by listing your debts from smallest to largest, regardless of the interest rates. This approach focuses on quick wins. Once you’ve made that list, commit to paying off the smallest debt first. Every extra dollar goes toward it while maintaining minimum payments on more significant debts.

When that small debt disappears, celebrate. Then, take what you were putting into that debt and apply it to the next one on your list. This creates momentum as you see progress, motivating you to keep going. Psychologically, this method builds confidence. Each paid-off balance feels like a victory, pushing you closer to financial freedom with every step taken.

Balance Transfers

If you have high-interest credit cards, transferring those balances to a card with a lower interest rate could save you money. Many lenders offer promotional rates that allow you to pay off your debt faster. It’s essential to read the fine print before making the switch. Look out for transfer fees and how long the promotional period lasts.

A 0% APR might seem appealing, but if you’re not careful, it could end up costing more in the long run. Once you’ve completed a balance transfer, focus on paying down that debt aggressively during the low-rate period. Set clear payment goals each month and stick to them.

Live Below Your Means

Living below your means isn’t just a financial strategy; it’s a lifestyle choice. It’s about making conscious decisions regarding spending and saving, prioritizing needs over wants. So, focus on evaluating your current expenses. Identify unnecessary subscriptions or impulse purchases that drain your budget.

This simple step can easily free up funds for debt repayment and savings. You can also try embrace frugality in daily life. Cook at home instead of dining out and opt for homemade gifts instead of store-bought ones. Small changes add up quickly. Living below your means fosters long-term financial health while reducing stress associated with money management.